Frequently asked questions

+ What is the Funding Finder?

Funding Finder is a searchable database of lenders and lending products (including a few equity products) offered in the Australian market by private, non-bank lenders. We believe it’s the most complete, most extensive such database in the country.

Funding Finder is owned by The Funding Doctor, a firm in the business of introducing borrowers and lenders.

At the moment, the Funding Finder database contains approximately 300 lending products, with more being added every day. The majority of these products are geared towards construction finance and asset-backed short-term lending.

Our mission is to disrupt the private lending market in Australia, to make it transparent, and to drive financing costs down by fostering competition between lenders. <;  data-preserve-html-node="true">

+ What are the main purposes of Funding Finder?

First, to give you information about what funding possibilities are available in the market.

Because many lenders are private individuals or small firms who lend on an ad hoc basis, it is impossible to definitively capture every lending possibility in the market. Nonetheless, our goal is to make the database as complete as possible, or at least to make it more complete than any other database.

One of our main motivations is to get rid of the old “bait-and-switch” model that many finance brokers use with clients – they tell you they can get you a super cheap rate, but when the actual offer comes through, it’s considerably more expensive. By the time you understand what’s happened, you don’t have time to find a better rate. It may be that that rate never existed, that the higher rate is the best that was ever going to be offered. We think the client has a right to know that up front.

A related problem is that you can never be sure there’s not a better deal on offer somewhere else – what we call the “monk over the hill” problem. With a market that’s so opaque, how do you know what’s really available? Is your broker or lender telling you the whole truth, or just giving you the facts they want you to have, the ones that make you sign their deal? It’s really hard to know.

So, we do what we can to give you more insight into what the market has to offer.

Our second purpose is, using the better knowledge we give you about what’s available in the market, to allow you to choose with confidence the most competitive rates and terms.

+ How does Funding Finder work?

Based on the information you input, Funding Finder uses a computer algorithm to match you with the lending products that are available for your project or loan type.

The more information you give the algorithm, the more accurate the matches are. That’s why you see the number of results going down as you answer more questions – when the system knows nothing, it assumes all products are available; as it learns more, it excludes the products that don’t match and would just be a waste of time.

Once you’ve seen what’s available, you can decide if you want to proceed with an application. UNTIL YOU GIVE US PERMISSION, YOUR INFORMATION IS COMPLETELY PRIVATE AND CONFIDENTIAL. Neither we nor any lender will contact you and no information about your deal will be sent to any lender, until you tell us it’s ok to do so.

In fact, until you provide us with contact information at the very end of the online application form, we have no way of contacting you.

If you decide you do wish to proceed, you can either (A) ask us to contact you to discuss the options that are available or (B) you can fill out the information required by the system and submit it electronically.

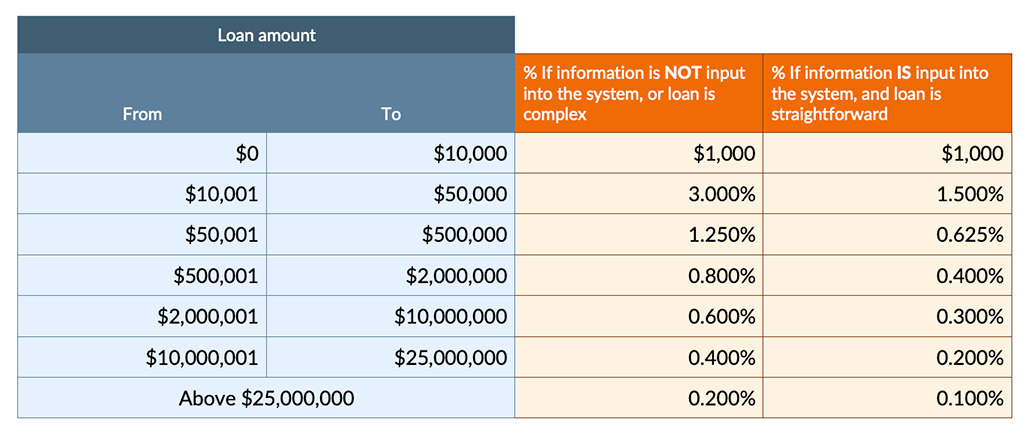

For many loans – particularly construction loans for projects that are fairly straightforward – this second option will reduce the fees we charge by approximately 50%. Thus, if our fee would normally be 0.40%, we will only charge 0.21% if you fill in the information requested.

The reason we do this is simple – it saves us a lot of time and effort if you input the information we need, and we’re happy to share those savings with our clients.

Whether you fill in the information on line or give us the information as part of a direct discussion, we review that information and submit it to the lenders that Funding Finder has identified as having products that match your lending needs.

Again, none of this happens UNTIL YOU GIVE US PERMISSION TO SHARE YOUR INFORMATION WITH THE LENDERS.

Once we submit the information to the lenders, they give us a preliminary indication as to whether they’re interested in the deal and what their indicative rates and terms would be (usually the same or very similar to what is outlined in the Funding Finder database). This usually happens within 24-48 hours.

We communicate the lender feedback to you, including sharing any indicative letters of offer we’ve received.

If you agree to one or more of the offers, you’d sign it and then begin working directly with the lender to complete their due diligence process.

Once the loan settles, The Funding Doctor receives a fee, as described in What fees do you charge? below.

+ What fees do you charge?

We generally aim to make our fees 30% to 50% lower than what’s currently standard in the market.

Most brokers charge around 1.0% of the loan balance as a brokerage fee. Sometimes this is augmented by a trail – a portion of the interest that’s paid by the lender to the broker. Trails are most commonly seen with commercial/investment loans, which have a term longer than 2 years. Brokerage fees are generally higher for short-term loans than for construction or commercial loans. As a percentage, fees are generally higher for smaller loans than for larger loans.

The Funding Finder’s fees are based on tiered pricing, similar to the way income tax rates work (but much cheaper, thankfully!) – smaller loan amounts attract higher rates; larger loan amounts get discounted rates. The minimum fee is always $1,000.

We also apply a 50% discount to the fees above the $1,000 minimum on many standard, uncomplicated loans if you input all the requested data. We don’t do this for all loans because some loans require human intervention, which is time-consuming and costly. For instance, a construction project on a site that has contamination issues will usually take time to evaluate and often has to be referred to specific lenders. For those loans where the algorithm can do the work of gathering the required information, we’re happy to share the savings with our clients.

+ Why can’t I see the lenders’ names? What is with the 3 letter aliases?

The way The Funding Doctor makes money from Funding Finder is by charging a referral fee, which is calculated as a percentage of the loan amount (see What fees do you charge? above).

If we made the names of the lenders public, many users would simply go directly to the lender, leaving no income stream for Funding Finder.

Also, business loans of the type listed in the Funding Finder database are complex, bespoke contracts between the borrower and the lender. Funding Finder attempts to describe the lenders’ offerings as accurately as possible, but we do not want to give the impression that a lender is guaranteeing a particular rate or set of terms – there may be reasons why the loan is more or less risky than what the information captured by Funding Finder would indicate, and the lender will make their own assessment and adjust their offer accordingly.

The three letter aliases are a way of keeping the lenders’ names private until such time as they issue a letter of offer to the client. At this point, the lender’s identity becomes known to the client, and the client and the lender deal directly with one another.

+ Are you a lender?

No, we are not a lender. We are only referrers, matching clients with funding needs to groups that have money to lend or to invest.

We also do not give financial advice.